Welcome to the vibecession, where the mood is heavy, even if the metrics paint a different picture.

Despite notable job growth and rising wages, financial anxiety casts a long shadow over many U.S. consumers, profoundly influencing their outlook on the economy and altering consumer behavior. This growing disconnect poses significant challenges for both companies and job seekers navigating this complex landscape.

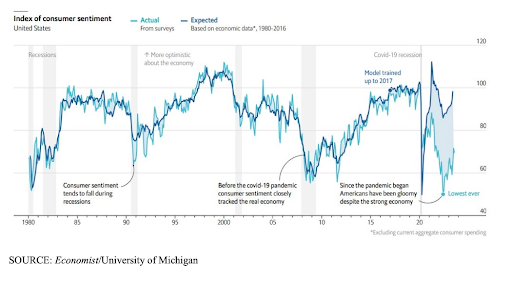

The pandemic fundamentally altered how Americans perceive the economy. As highlighted by recent data from the University of Michigan, the gap between economic reality and consumer sentiment is wider than ever. Prior to COVID-19, consumer sentiment closely mirrored economic performance. However, since the pandemic, a troubling trend has emerged: while overall sentiment still correlates with economic indicators, many individuals perceive the economy as performing far worse than the data suggests.

For companies, this disconnect means that even positive financial metrics may not translate into increased consumer spending. Businesses must recognize that consumer confidence is essential for driving demand. As financial anxiety persists, companies may face challenges in achieving growth targets, despite favorable economic conditions. This creates a crucial need for businesses to actively engage with consumers, build trust, and address their concerns through effective communication and support.

For job seekers, the vibecession presents its own set of hurdles. Even in a job market characterized by growth, the pervasive financial anxiety can lead to increased competition for positions as candidates may feel compelled to apply for any available role rather than waiting for their ideal job. This environment can diminish the perceived value of jobs and create a sense of urgency that may not reflect the true opportunities available.

Moreover, job seekers may struggle with self-doubt and anxiety, questioning their worth in a market where sentiment seems to overshadow actual opportunity. To succeed in this climate, candidates must remain adaptable, highlighting their unique skills and resilience, and staying informed about market trends to make strategic career moves. This is where personal branding and the power of storytelling comes in.

In this vibecession, companies and job seekers alike must navigate a landscape marked by uncertainty. For organizations, fostering a culture of transparency and support is essential to rebuild consumer confidence and encourage spending. Meanwhile, job seekers should focus on personal branding and networking, leveraging their skills to stand out in a competitive market. It all starts with career clarity. And identifying what can help you stand out.

Understanding the nuances of this vibecession is key for both companies and job seekers. By addressing the emotional undercurrents that drive behavior, they can better align strategies and expectations with the realities of today’s economy. And plan for career growth over the next three to five years.

The reasons behind this paradoxical phenomenon are multi-faceted. Yes, the conventional metrics for macro-economic health like employment rates and wages are looking good. However, prevailing challenges in housing affordability and inflation’s lingering effects contribute to continued economic pessimism. For many Americans, especially those in the younger generations, the big-ticket items in life, such as college tuition, home mortgages, and saving enough for retirement, are becoming increasingly out-of-reach.

On top of that, the double-whammy of climate change and geopolitical uncertainty are also stoking the fire of financial anxiety for many. Apprehensions over the consequences of these two hyperobjects are directly impacting how consumers are planning for their future, creating new needs for financial service brands to fulfill.

Finding a New Normal in The Post-ZIRP Era

The end of the Zero Interest Rate Policy (ZIRP), or as some in Silicon Valley call it, “the end of free money,” contributes significantly to widespread financial anxiety. For over a decade, ZIRP made borrowing money incredibly cheap, encouraging spending and job creation. However, this era of artificially low rates has now concluded, and Americans now face a more challenging financial landscape as a result.

The transition from a low to a high-interest environment disrupts familiar financial norms. While the end of ZIRP should ideally lead to a fairer, more sustainable economy by redirecting money into long-term investments and sustainable companies, the immediate impact is a period of adjustment. Naturally for many Americans, who have grown accustomed to cheap mortgages and a booming stock market, the new economic conditions feel unsettling and fuels anxiety.

According to the central bank’s most recent projections, rates will stay where they are for most of 2024 and will fall only slightly in 2025, ending the year at about 4 percent — more than twice as high as in late 2019. With interest rates projected to remain high, borrowing costs for mortgages, car loans, personal loans, and credit cards will also stay high. This makes existing debts more expensive and future borrowing less attractive, adding stress to household budgets.

In the post-ZIRP era. higher interest rates now make savings accounts and fixed-income investments more attractive than riskier assets such as stocks and real estate This shift causes market volatility and uncertainty, impacting retail investors and contributing to financial anxiety.

As a minor casualty in the end of ZIRP, the cooling of Buy Now, Pay Later (BNPL) options, exemplified by Apple scrapping its Apple Pay Later service, further underscores the tightening financial conditions. These short-term loans had provided temporary relief for consumers, and their disappearance adds to the financial pressures many face.

The Double Whammy of Climate and Political Uncertainties

Climate change is increasingly seen as a major economic risk. The U.S. has already experienced eleven billion-dollar disasters this year, with severe weather events impacting agricultural yields and home insurance costs.

Extreme weather and soil depletion are reducing yields for essential commodities, driving up grocery prices. For instance, Florida’s orange and sugar crops have suffered extensive damage due to climate change and invasive diseases, leading to sustained inflation in orange juice — a staple on many Americans’ breakfast tables.

Meanwhile, states like California, Texas, Florida, and New Jersey face skyrocketing home insurance costs due to their susceptibility to extreme weather. At the state level, insurers are pushing back against local policies that forbid them from pricing climate risks into their models, and Florida has new legislation requiring more transparency in the housing market around regional flooding histories.

All these have been weighing heavily on consumers. According to Google, global searches related to “climate” or “eco-anxiety” have increased by a staggering 4,590 percent since 2018. A recent global study, which surveyed 10,000 young people from 10 countries, showed that nearly 60 percent of them were extremely worried about the future state of the planet.

In addition to anxieties around climate change, geopolitical uncertainties, ranging from ongoing regional wars to unstable democracies, is creating an unpredictable economic environment, which adds to the spreading financial anxiety among consumers. 2024 is the biggest election year in history, with over 4 billion people worldwide, including U.S. citizens, heading to the polls and casting their votes for the future. Judging by the results from the recent European Parliament elections, things are not looking so rosy.

Combining those two existential threats, no wonder many in the younger generation are embracing a “YOLO” spending mindset. Even as Americans owe $1.13 trillion on their credit cards, consumers are still willing to splurge on travel and entertainment this summer. Young adults, especially, are focused on enjoying life in the moment rather than saving for the future. A third of Gen Z and 32% of Millennials reported that they are more interested in having fun than saving money this summer. After all, why save for retirement or to buy a house if you don’t think the government, or even the planet itself, will still be functioning in 50 years?

Of course, this type of financial nihilism is short-sighted and unsustainable. At some point, one would realize that regardless of how shitty things get, life goes on. And it’s always better to have a plan than being caught flat-footed. Yet, despite the growing financial risks posed by climate change and political instability, there is a notable lack of financial advice addressing these issues. Financial reporters, columnists, and influencers have an opportunity to fill this gap by providing targeted advice on how to protect their financial health in an increasingly uncertain world.

Social Media and Money Dysmorphia

Not to blame everything on social media like an old man yelling at the clouds, but studies have shown that social media has been fueling a sense of financial insecurity amongst Millennials and Gen Z. Influencers and online trends tend to showcase unattainable standards of wealth, from luxurious lifestyles to extravagant purchases. These curated snapshots create unrealistic benchmarks for financial success, leading young consumers to feel inadequate and anxious about their financial status. Similar to how social media boosts unhealthy body images and exacerbates people’s body dysmorphia, so does it impact young people’s self perception about their personal finances.

This sense of money dysmorphia affects 43% of Gen Zers and 41% of millennials, according to a December 2023 survey by Qualtrics for Intuit Credit Karma. Despite the perception of financial inadequacy, a significant portion of these individuals are not in dire straits: 37% have over $10,000 in savings, and 23% have over $30,000. This disparity between perception and reality highlights the powerful influence of social media.

In response to this pervasive anxiety, Gen Z has become increasingly obsessed with credit scores. This tangible measure of financial health offers a sense of control and validation in an otherwise overwhelming financial landscape. Meanwhile, Millennials are compulsively checking their bank account balances. 58% of Millennials say they check their account balances daily, driven largely by fear and anxiety about their finances facilitated by mobile banking apps.

Amidst this anxiety, banks are increasingly marketing themselves as “boring” to appeal to customers’ desire for stability and safety. PNC Bank’s “brilliantly boring” campaign and the increased use of the term “boring” in banking management discussions reflect this trend. Following the tumultuous year of bank collapses, stability has become a highly valued commodity.

As social media continues to shape perceptions of wealth and success, financial anxiety among younger generations is likely to persist. To address this, financial institutions and influencers need to provide more realistic, relatable financial advice, and promote healthy financial behaviors. By leveraging data to offer personalized insights and emphasizing stability and security, banks can help alleviate the pervasive sense of financial anxiety.

What Financial Service Brands Can Do In Response

As Inside Out 2 recently demonstrated to millions of parents and kids, anxiety can be a useful emotion to have when it is prompting ample preparation and planning to avoid potential problems. But, when anxiety fully takes over and becomes the single dominant mood, a debilitating sense of insecurity and acts of self-sabotage tend to follow.

Although financial institutions can’t single-handedly fix the broader economic problems, they have a key role to play in easing financial anxiety. By creating innovative solutions, improving communication, and offering targeted support, they can meet their customers’ pressing new needs while fostering lasting trust and loyalty in these uncertain times.

The ongoing “vibecession” and spreading financial anxiety underscore the need for a more nuanced approach to personal finance. By addressing the specific challenges posed by the new post-ZIRP reality, climate change, and political instability, financial experts and institutions can help individuals better navigate these uncertain times.

For example, a reinsurance company called Swiss Re has acknowledged that its industry fails to aptly factor disaster and climate risks into its calculations, and is working to overhaul its equations. Meanwhile, advances in AI are helping to improve extreme-weather predictions and risk forecasts, which can also be incorporated into insurance products to help alleviate climate anxiety.

Similarly, financial service providers can also play a crucial role in helping customers prepare for political instability. This could involve offering investment advice on diversifying assets globally, providing information on safe-haven investments like gold and government bonds, and, if your brand has an international footprint, tailoring services that help customers navigate the complex financial implications of moving abroad.